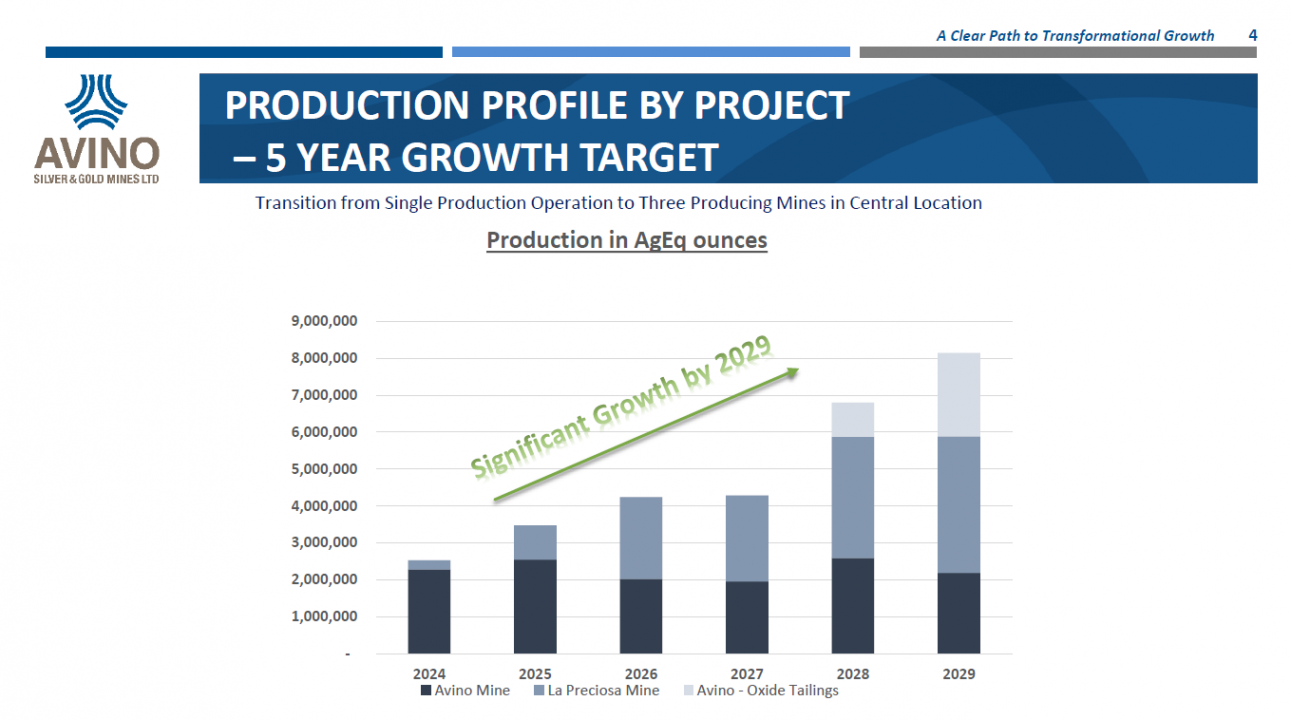

Production Profile by Project - 5 Year Growth

The annual production presented is based on internal estimates and current plans which are subject to change. Silver equivalent ounces figures used to show production by project are calculated based on metal price assumptions of $23.39/oz Ag, $1,943/oz Au, and $3.85/lb Cu.

* CAUTIONARY DISCLAIMER: FORWARD-LOOKING STATEMENTS

This graph contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company’s Avino Property, including La Preciosa, located near Durango in west-central Mexico (the “Avino Property”) with an effective date of November 30, 2022, prepared for the Company, and references to Measured, Indicated, Inferred Resources dated October 16, 2023 as well as the Prefeasibility Study dated January 16, 2024 and references to Measured, Indicated Resources, and Proven and Probable Mineral Reserves referred to in this press release. This information and these statements, referred to herein as “forward-looking statements” are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the estimated amount and grade of mineral reserves and mineral resources, including the cut-off grade; (ii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of operating the mine, of sustaining capital, of strip ratios and the duration of financing payback periods; (iii) the estimated amount of future production, both ore processed and metal recovered and recovery rates; (iv) estimates of operating costs, life of mine costs, net cash flow, net present value (NPV) and economic returns from an operating mine; and (v) the completion of the full Technical Report, including a Preliminary Economic Assessment, and its timing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “envisages”, “assumes”, “intends”, “strategy”, “goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this update and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Such factors and assumptions include, among others, the effects of general economic conditions, the prices of gold, silver, and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 40-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into Reserves as defined under SEC Industry Guide 7.

The Company has not based its production decisions on a feasibility study or mineral reserves demonstrating economic and technical viability, and as a result there is increased uncertainty and there are multiple technical and economic risks of failure, which are associated with these production decisions. These risks, among others, include areas that would be analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy, and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.

Cautionary Note to United States Investors - The information contained herein and incorporated by reference herein has been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. In particular, the term “resource” does not equate to the term “reserve”. The U.S. Securities and Exchange Commission’s (the “SEC”) disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by SEC standards, unless such information is required to be disclosed by the law of the Company’s jurisdiction of incorporation or of a jurisdiction in which its securities are traded. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.