The San Gonzalo Mine, currently on care and maintenance, is located approximately 2 km North East from the original Avino mine and beneath the shallow workings of an old mine from the colonial period. It constitutes a strongly developed vein system over 25 m across, trending 300 to 325 degrees, dip 80 NE to 77 SW. The original underground workings extend over an area approximately 150 m along strike and 136 m in depth.

Operations

2019 was a transitional year for Avino. The transition began with the winding down and ultimately the stoppage of mining at San Gonzalo during the fourth quarter of 2019. The San Gonzalo mine which began commercial production in 2012 out-performed its 5-year mine life by exceeding that timeline by two years and produced just over 6 million silver equivalent ounces at an average all-in sustaining cash cost per silver equivalent ounce of under US$10.

The San Gonzalo Mine was an underground operation that used both shrinkage stoping and cut and fill mining methods to extract mineralized material. Once mineralized material was broken from the stopes, it was transported to the surface and trucked 2 km to the mill where it was processed.

A 250 tonne per day bulk flotation circuit (Mill Circuit 1) at the processing plant was then used to produce a bulk concentrate that contained silver, gold, lead and zinc. The concentrate was then transported to Manzanillo, Mexico on a monthly basis where it is shipped and sold.

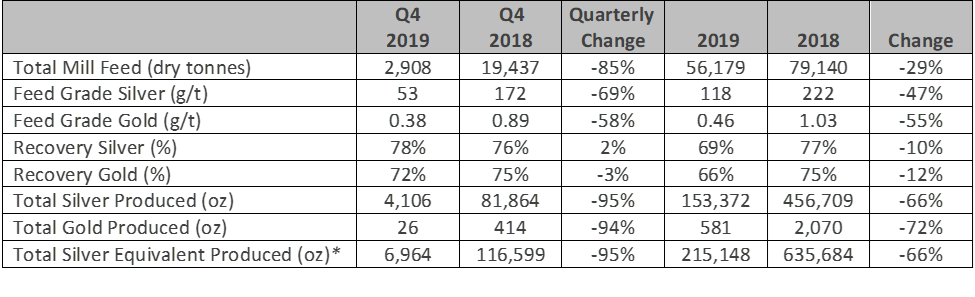

San Gonzalo Production Highlights - Q4 and Full Year 2019

*In Q4, 2019, AgEq was calculated using metals prices of $17.32 oz Ag, $1,482 oz Au and $2.67 lb Cu. In Q4, 2018, AgEq was calculated using metals prices of $15.71 oz Ag, $1,270 oz Au and $2.96 lb Cu. Calculated figures may not add up due to rounding.

*In 2019, AgEq was calculated using metals prices of $16.20 oz Ag, $1,393 oz Au and $2.96 lb Cu. In 2018, AgEq was calculated using metals prices of $15.71 oz Ag, $1,270 oz Au and $2.96 lb Cu.

*For the year ended December 31, 2019, the Company produced 958 and 20,412 AgEq oz, respectively, of zinc by-product concentrate which has been included in the “San Gonzalo” production category above

San Gonzalo reached the end of its current resources in Q4 and mining was stopped. It will remain open for continued exploration at different underground levels.

Comparative figures for 2016 through 2018 are presented below:

|

|

2018 |

2017 |

2016 |

|

Total Mill Feed (dry tonnes) |

79,140 |

81,045 |

108,943 |

|

Feed Grade Silver (g/t) |

222 |

269 |

267 |

|

Feed Grade Gold (g/t) |

1.03 |

1.32 |

1.25 |

|

Recovery Silver (%) |

77% |

84% |

83 |

|

Recovery Gold (%) |

75% |

78% |

74 |

|

Total Silver Produced (Kg) |

13,500 |

18,375 |

25,588 |

|

Total Gold Produced (g) |

60,800 |

83,215 |

106,599 |

|

Total Silver Equivalent Produced (oz)¹ |

592,098 |

789,157 |

1,073,062 |

1 Metal Production is expressed in terms of silver equivalent ounces, (oz Ag Eq.), the formula for which depends on the gold and silver metal prices used in each year and hence are only indicative. In 2018, AgEq was calculated using metals prices of $15.71 oz Ag, $1,270 oz Au and $2.96 lb Cu. In 2017, AgEq was calculated using metals prices of $17.05 oz Ag, $1,258 oz Au and $2.80 lb Cu.In 2016, AgEq was calculated using metals prices of $17.10 oz Ag, $1,248 oz Au and $2.21 lb Cu. In 2015, AgEq was calculated using $16 oz Ag, $1,150 oz Au and $3.00 lb Cu

Resource Estimates

In January 2021, Avino announced the results of an updated resource estimate for the Avino property, which was amended on December 20, 2021. The updated estimate includes the Property’s Avino Mine (Elena Tolosa (“ET”) vein systems, the San Gonzalo Mine, and the Property’s Oxide Tailings. The mineral resources estimate has been included in an updated technical report prepared by Tetra Tech Inc. under National Instrument 43-101 (“NI-43-101”), which will be available on SEDAR (www.sedar.com) under the Company’s profile and filed on Form 6-K with the SEC within 45 days.

Qualified Person

Avino’s Mexican projects are under the supervision of Peter Latta, P.Eng, MBA, Avino’s VP Technical Services who is a qualified person within the context of National Instrument 43-101 and has reviewed and approved the technical data herein.

Under National Instrument 43-101, the Company is required to disclose that it has not based its production decisions on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically projects without such reports have increased uncertainty and risk of economic viability. The Company’s decision to place a mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations is largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company. The results of this work are evident in the Company’s discovery of the San Gonzalo resource, and in the Company’s record of mineral production and financial returns since operations at levels intended by management commenced at the San Gonzalo Mine in 2012. This approach is being applied for the advancement of the Avino Mine project, for which similar risks and uncertainties have been identified.