Click to View Full Resource Summary for:

1. The Avino Property

2. La Preciosa Property

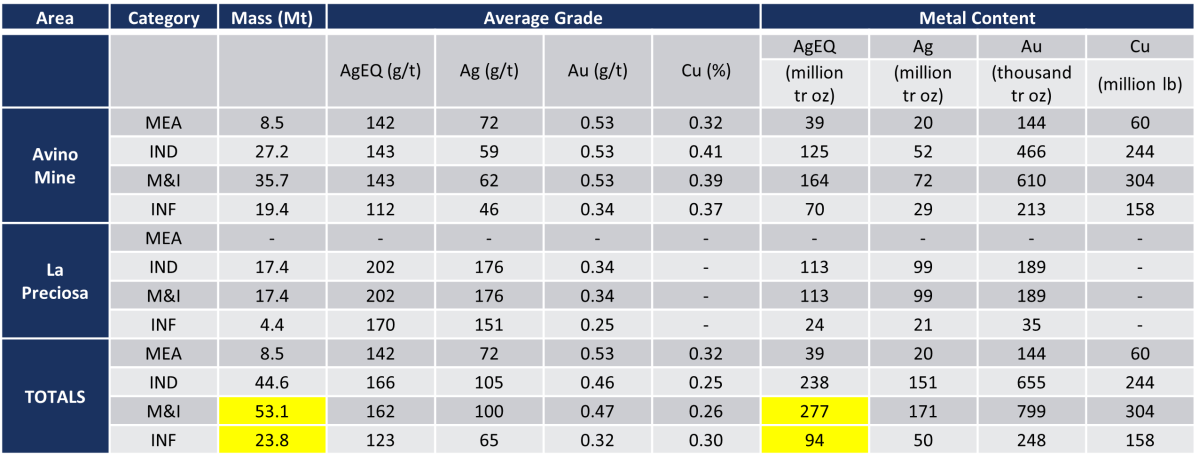

Consolidated Mineral Resources

Avino Property (including La Preciosa area) – Mineral Resources (inclusive of Oxide Tailings Mineral Reserves) Effective Date: October 16, 2023

1. Figures may not add to totals shown due to rounding.

2. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. The Mineral Resource estimate is classified in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves incorporated by reference into

NI 43-101 Standards of Disclosure for Mineral Projects.

4. Mineral Resources are stated inclusive of Mineral Reserves.

5. Based on recent mining costs provided by Tetra Tech, Mineral Resources are reported at cut-off grades 60 g/t, 130 g/t, and 50 g/t AgEQ grade for ET, San Gonzalo, and

oxide tailings, respectively.

6. AgEQ or silver equivalent ounces are notational, based on the combined value of metals expressed as silver ounces.

7. Metal price assumptions are US$21/tr.oz. Ag; US$1800/tr.oz. Au.

8. Metal recovery is based on operational results and column testing, 82% Ag and 78% Au, respectively.

9. The silver equivalent for the mineral resources was back-calculated using the following formulae:

a) ET, Guadalupe, La Potosina: AgEq = Ag (g/t) + 71.43 * Au (g/t) + 113.04 * Cu (%)

b) San Gonzalo: Ag Eq = Ag (g/t) + 75.39 * Au (g/t)

c)Oxide Tailings: Ag Eq = Ag (g/t) + 81.53 * Au (g/t)