Our History

-

1968 - 2001

Silver was first discovered on the Avino property by Spaniards in the mid 1500s. Native populations had been extracting silver from the area for many years before the Spaniards arrived. The Avino property was mined sporadically from 1555 to the early 1900s. By 1908, the Avino mine was considered to be the largest open cut operation in the world. The mine closed in 1912 during the Mexican Revolution.

In 1967, a chance meeting between Fernando Ysita and Louis Wolfin sparked a chain of events that would breathe life into the Avino mine once again. Ysita’s description of the Avino properties convinced Wolfin to send a geologist named Don Cannon to Durango. Expecting to visit an undeveloped property, Hicks instead found a once operative mine. Seeing the opportunity in this revelation prompted Wolfin to journey to Durango himself.

It didn’t take long for Lou Wolfin to understand the great potential for a significant silver mining operation. Shortly after his initial visit to the property the Ysita family (51%) and the Avino Mines of Vancouver, BC (49%) jointly formed the private Cia Minera Mexicana de Avino, which acquired the property rights and the mineral rights for the mine and the surrounding property.

The 51/49 split was in keeping with the 1961 Constitution on the Exploration and Treatment of Mineral Resources. The 1961 amendment included a stipulation restricting foreign ownership in mining projects to a maximum 49 percent. The legislation had amended Article 27 of the 1917 Mexican Constitution which originally gave the government of Mexico direct control of the nation’s mineral resources, cutting out foreign ownership of mining concessions.The property was initially examined by Cannon Hicks beginning in 1968, then by Selco Mining and Development who verified it as a property of real merit that presented an unusual opportunity to a developer. After extensive exploration of the Avino vein, results showed very large reserves of economically viable commercial copper ore in addition to silver and smaller quantities of gold. All results proved the Avino property to be an excellent target for development. However, much to the chagrin of Avino’s directors and shareholders, the Company’s fortunes did not develop as anticipated. The copper markets plunged, while the capital required to set up the originally planned 5,000 ton per day concentrator was no longer readily available.

In 1973, following an upsurge in metal demand, metals prices made an exceptional recovery with silver and gold posting record highs. Avino’s fortunes rapidly changed; it now became imperative to act. With the aid of the Seridan Group, a Canadian firm which supplied the development capital and engineers to operate the mine, Avino’s future was determined. By the Spring of 1974, the Avino mine was once again back in production. Rather than focusing on the copper content as had been the practice in the past, the directors came to realize the real value of the property lay in the silver reserves. Bearing this in mind, S.G.I. Limited of the Bahamas undertook management of the mine. The immediate operating plan was to begin construction of a 500 ton per day plant to treat the prepared ore. The plan was unique in that it called for partial production while construction was still in progress. As a result, by September 1974 the copper, silver and gold concentrates produced brought $331,290 in revenue.The recommencement of mining operations in Durango not only signaled financial promise for the parties involved, but brought back economic opportunities for the community that had lived in poverty since the revolution forced the mine’s closure decades before. The success of the Avino project was an excellent example of the result of cooperative effort. The government built new roads, provided electrical power and greatly reduced the company’s tax rate from the maximum by granting rebates and large subsidies.

Starting in 1974, open-pit production was continuous and by 1986 had produced concentrates containing 3.7 million ounces of silver and 12,500 ounces of gold. Subsequent to 1987, record keeping improved and reports show that between 1987 and 1992, 1.14 million tonnes were treated recovering an additional 4.2 million ounces of silver and 19,100 ounces of gold. Production continued from the Avino vein by ramp accessed underground mining until 2001 when changing economics resulted in the closure of the operation. Between 1993 and 2001 a total of 2.9 million tonnes of sulphide ore was treated containing 7.9 million ounces of silver, 68 thousand ounces of gold and 23.7 million pounds of copper.In 1994 the North American Free Trade Agreement (NAFTA) was implemented and the Mexican Peso was devalued. Because of low metal prices and a devalued Peso many walked away from toiling in the earth, shutting down their mines and finding new livelihoods.

By November 2001, the successful results of the mining operations at Avino were overshadowed by the collapse of commodities prices (including copper and silver) and the devalued peso. At the time, silver was trading at around $4 an ounce, and despite the low prices Avino’s low-cost, high volume operations were still allowing the Company to break even; however, the depressed copper price also led to the closure of the key copper smelter treating Avino’s concentrates, resulting in the mine being placed on care and maintenance.During the three decades that the mine was in production under Avino, silver grades averaged from 3 to 7 ounces per ton with more than 16 Moz of silver, 96,000 oz of gold and 24Mlb of copper being produced.

Production Highlights

1977 First cash return; increase to 600 tpd 1980 Produced 1635 tonnes of concentrate containing 32 kilos of gold, 64 tonnes of copper and 298,000 ounces of silver. May 1981 In an effort to bring production to 2,000 tonnes per day, rate increased slowly starting to 750 tpd 1983 Produced 425,068 ounces of silver record 1985 1000 tpd average 473,000 ounces another record 1986 1200 tpd 1987 474,838 ounces record production 1988 558,264 ounces record production 1989 873,000 ounces record production By 1993 An approximate total of 2 Mt of oxidized ore had been produced from open-pit and treated. That same year, underground mining of sulphide ore had commenced from which a copper concentrate was recovered by flotation with silver and gold credit received from the copper smelter. 1994 912,907 ounces record production In 1997 To better reflect its exploration and mining goals, the Canadian-based company took on the corporate name Avino Silver & Gold Mines Ltd 1999 End of open-pit production Between 1993 and the mine’s temporary closure in 2001, an approximate total of 3 Mt of sulphide ore had been treated. During the period of operations between 1976 and 2001, approximately 497 tonnes of silver, 3 tonnes of gold and 11,000 tonnes of copper were produced from the Avino mine.

-

2006 - 2017

… Today, the challenge is to continue to demonstrate that the story is ongoing—that Avino has an ore-body that will provide resources for further development for as far as we can see into the future because the ore body is so extensive that is has never been totally assessed. Fernando Ysita 1974

In 2006, the North American Free Trade agreement which had been so detrimental to mining in Mexico in the 1990’s now presented Avino with a silver lining. As part of the NAFTA agreement, Mexican law changed to allow 100% foreign ownership of Mexican mines. With metals prices still low, Avino seized upon a golden opportunity and bought the remaining 51% interest of Cia Minera Mexicana de Avino; finally taking full control of the property.

For years, operations at the Avino property had focused on the resource-abundant Avino vein; however, starting in 2006, the Company began an aggressive exploration program that continues today. The historic near-to-surface mining on the property provided excellent starting points for targeting potential mineralization hot spots. Extensive drill programs have identified several new gold, silver, lead and zinc mineralization structures including the San Gonzalo and Santiago Veins.

San Gonzalo

The high-grade San Gonzalo zone is located 2 km from the original mine and underneath the workings of a shallow mine from the British era.

In 2008, after drilling 40 holes, a maiden resource calculation was completed by Orequest consultants on the then-explored portion of the San Gonzalo vein. Results from the report and preliminary metallurgical test work were favourable.

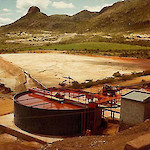

In 2008, Avino commissioned a re-build of the milling facility in anticipation of mining at San Gonzalo. By August 2010 the mill was back online. The facility, with an independently assessed replacement value of more than US$40 million.

Encouraged by the 2009 resource calculation, Avino initiated a 10,000 tonne bulk sampling program in late 2009 to assess the economic viability of the zone and confirm mineral grades. The Company completed the bulk sample program in April 2011, producing 232 dry tonnes of flotation concentrate. The results of the program showed a feed grade of 261g/t silver and 0.9g/t gold. Silver and gold recoveries improved over the course of the bulk sample and averaged 76% and 59% respectively.

Processing the high-grade material from the San Gonzalo zone required Avino to refurbish its existing mill, which prior to the 2001 closing had been configured to operate at a rate of 1,000 tonnes per day (“tpd”). Along with conducting extensive upgrades and repairs throughout the mill, the Company re-conditioned 2 existing 250 tpd circuits increasing the total potential operation rate of the mill to 1,500 tpd. Avino’s importance and reputation as a prominent employer in the Durango area made it possible to hire back personnel who had operated the mill prior to the 2001 closure, to the benefit of both the Company and the community.

The success of the bulk sample program prompted Avino to continue implementing its mine plan to develop the 3rd, 4th and 5th levels of the San Gonzalo Mine to provide milling operations with a sustainable feed at a rate of 250 tpd. Production at levels intended by management at San Gonzalo began on October 1st 2012.*

Avino Vein (ET Zone)

Pursuant to a new royalty agreement completed in Feb 2012, Avino began development to re-open the main Avino Mine where underground mining stopped in 2001. A new resource estimate was published in July 2013 which included drilling from 2007, 2008 and 2012. The company completed de-watering the mine in 2014 and resumed full scale operations on January 1, 2015.*

Tailings Resource

Open pit and underground mining of the Avino Vein between 1968 and 2001 left behind a large tailings resource that Avino is continuing to analyze for re-processing. This resource includes both oxide and sulphide tailings, with each requiring separate treatment methods. Advances in heap leach technology and improved metals markets will now enable Avino to potentially unlock the gold and silver contained in the tailings.

Exploration

Further exploration work to define new high potential targets on the property includes using modern technology to integrate, manage and interpret more than 80 km of Induced Polarization (IP) Geophysics, 1,500 soil samples, satellite imagery, and data from ongoing drilling and historic data.

Even after over 400 years of mining operations on the property, exploration work at Avino is uncovering the potential for a substantial resource base that could ensure Avino Silver & Gold Mines’ future status as a mid tier silver producer.

Sadly, company founder Louis Wolfin passed away in March, 2017. He will be forever recognized as a visionary in the industry. The vision he established so many years ago, and reinforced by David Wolfin in the 21st century, has clearly been validated.

Qualified Person(s)

Avino’s projects are under the supervision of Peter Latta, BASc, P.Eng, Avino’s VP Technical Services, who is a qualified person within the context of National Instrument 43-101 and has reviewed and approved the technical data herein.

*Under National Instrument 43-101, the Company is required to disclose that it has not based its production decisions on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically projects without such reports have increased uncertainty and risk of economic viability. The Company’s decision to place a mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations is largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company. The results of this work are evident in the Company’s discovery of the San Gonzalo resource and the re-opening of the Avino Mine, and in the Company’s record of mineral production and financial returns since operations at levels intended by management commenced at the San Gonzalo mine in 2012.

This website is updated regularly. For more information post 2017, please go to News.