Related Document

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE, “Avino” or “the Company”) is pleased to announce the filing of the mineral resource estimate (the “Report”) addressed to the Company on the La Preciosa project located near Durango in west-central Mexico (the “La Preciosa Property”), which the Company is proposing to acquire. The report was prepared by Tetra Tech Inc. under National Instrument 43-101 (“NI-43-101”), and is now available on SEDAR (www.sedar.com) under Avino’s profile and filed on Form 6-K with the SEC.

Highlights

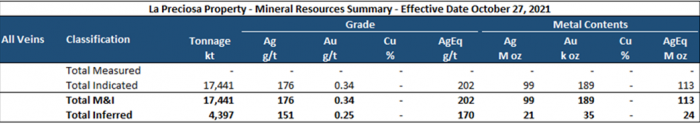

Indicated Mineral Resources (at 120 AgEq g/t cutoff):

- 113 million silver equivalent oz

- 17.4 million tonnes

- Average silver equivalent grade of 202 AgEq g/t

- Average silver grade of 176 Ag g/t

- Average gold grade of 0.34 Au g/t

- 99 million ozs contained silver

- 189 thousand ozs contained gold

Inferred Mineral Resources (at 120 AgEq g/t cutoff):

- 24 million silver equivalent oz

- 4.4 million tonnes totaling 24 million AgEq oz

- Average silver equivalent grade of 170 AgEq g/t

- Average silver grade of 151 g/t

- Average gold grade of 0.25 g/t

- 21 million ozs contained silver

- 35 thousand ozs contained gold

Table – As Disclosed on October 27, 2021

- The stated mineral resources comply with the disclosure requirements of NI 43-101 and are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards – For Mineral Resources and Mineral Reserves”.

- Mineral resources for La Preciosa are estimated at a cut-off grade of 120 g/t AgEq.

- Mineral resources for La Preciosa are estimated using a long-term silver price of US$19.00/oz and a long-term gold price of US$1,750/oz.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- Tonnage and metal content figures are expressed in thousands and may not add up due to rounding.

Avino President and CEO, David Wolfin commented: “As we stated on October 27th, 2021, we believe this proposed transaction to acquire La Preciosa to be transformational for Avino shareholders if completed. The mineral resource estimate for La Preciosa will provide Avino with substantial inventory, which, if the proposed transaction is closed, will increase the consolidated NI43-101 mineral resources to over 235 million silver equivalent ounces, adding to the significant base we have at Avino and further supports our belief that we are poised for growth as well as elevating Avino’s potential as a silver producer and developer in Mexico.”

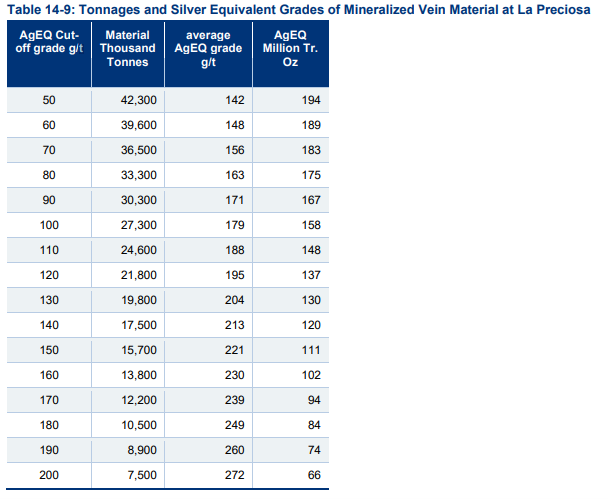

Cut-off Grade

Based on historic underground mining methods, Avino has selected a cut-off grade of 120 AgEq as a base-case scenario; however, further optimization work will determine and refine the appropriate cut-off grade for economic extraction of ore.

A table disclosing tonnage, average AgEq grade and total AgEq ounces at a variety of cut-off grades can be found below and in the report as filed on SEDAR.

Proposed Acquisition of La Preciosa

On October 27, 2021, Avino announced that it had entered into a share purchase agreement (the “Transaction”) to indirectly acquire through the purchase of the shares of certain holding companies, the La Preciosa Property from Coeur Mining, Inc. (NYSE: CDE) (“Coeur”). The La Preciosa Property is a development stage mineral property, hosting one of the largest undeveloped primary silver resources in Mexico, and is located adjacent to Avino’s existing operations at the Avino Property in Durango, Mexico.

The completion of the proposed Transaction remains subject to a number of customary conditions precedent, as well as the authorization of the Mexican Federal Economic Competition Commission, we expect to obtain Cofece approval during Q1 2022, approval of the issuance of the Unit consideration and contingent payment amount by the NYSE American, the Toronto Stock Exchange, and any other necessary third party approvals. The closing of the Transaction is expected to occur during Q1 2022. There can be no assurance that the proposed Transaction will be completed as proposed or at all.

The Company is intending to rely on the interlisted issuer exemption outlined in TSX Policy Manual - Section 602.1 The Company has received conditional approval from the TSX of the proposed Transaction on December 20, 2021.

Avino has agreed to pay cash consideration of US$20 million of which US$15 million is payable at the closing of the Transaction from Avino’s cash on hand. The remaining US$5 million is payable before the first anniversary of the closing date. Avino will execute a note payable in favor of Coeur with respect to the remaining cash consideration on customary terms. Avino will also issue 14 million units consisting of a share and one-half warrant upon closing to Coeur.

The complete terms of the transaction are provided in this link to our news release dated October 27, 2021 - Avino to Acquire La Preciosa.

Qualified Person(s)

The Qualified Persons as defined by NI 43-101, who are responsible for the technical content of this news release is Michael O’Brien P.Geo., Senior Principal Consultant, Red Pennant Geoscience, and under the supervision of Peter Latta, P.Eng, Avino’s VP, Technical Services, all of whom are qualified persons within the context of NI 43-101.

About Avino

Avino is primarily a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company’s silver and gold production remains unhedged. The Company’s mission and strategy is to create shareholder value through organic growth at the historic Avino Property and the strategic acquisition of mineral exploration and mining properties. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on Twitter at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines.

On Behalf of the Board

“David Wolfin”

________________________________

David Wolfin

President & CEO

Avino Silver & Gold Mines Ltd.

This news release contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the amended mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico (the “Avino Property”) with an effective date of January 13, 2021, prepared for the Company, and La Preciosa’s updated October 27, 2021 resource estimate and references to Measured, Indicated, Inferred Resources referred to in this press release. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements. No assurance can be given that the Company’s Avino Property nor the La Preciosa Property have the amount of the mineral resources indicated in their reports or that such mineral resources may be economically extracted. Such factors and assumptions include, among others, the effects of general economic conditions, the price of gold, silver and copper, changing foreign exchange rates and actions by government authorities, uncertainties associated with legal proceedings and negotiations and misjudgments in the course of preparing forward-looking information. In addition, there are known and unknown risk factors which could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Known risk factors include risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; the COVID-19 pandemic; volatility in the global financial markets; fluctuations in metal prices; title matters; uncertainties and risks related to carrying on business in foreign countries; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain of our officers, directors or promoters with certain other projects; the absence of dividends; currency fluctuations; competition; dilution; the volatility of the our common share price and volume; tax consequences to U.S. investors; and other risks and uncertainties. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For more detailed information regarding the Company including its risk factors, investors are directed to the Company’s Annual Report on Form 20-F and other periodic reports that it files with the U.S. Securities and Exchange Commission.

References to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this press release are terms that are defined under Canadian rules by National Instrument 43-101 (“NI 43-101”). U.S. Investors are cautioned not to assume that any part of the mineral resources in these categories will ever be converted into Reserves as defined under SEC Industry Guide 7.