A mineral resource statement for the La Preciosa property with an effective date of October 2023, can be viewed within Avino’s latest technical report dated February 5, 2024. The report was prepared by Tetra Tech Inc. under National Instrument 43-101 (“NI-43-101”), and is available on SEDAR+ (www.sedarplus.ca) under Avino’s profile and filed on Form 6-K with the SEC.

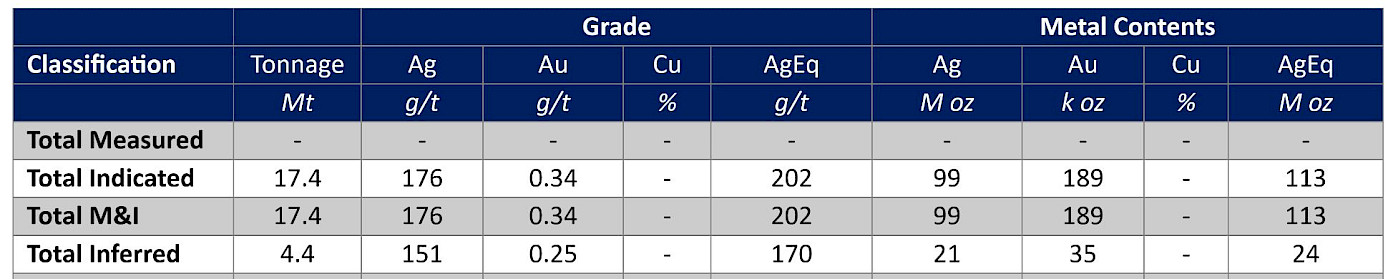

The following table summerizes as at October 16, 2023 the Company’s estimate mineral resources at its La Preciosa Property. As mentioned above, the entire Technical Report was prepared by Tetra Tech Inc. under National Instrument 43-101 (“NI-43-101”), and is available on SEDAR +(www.sedarplus.ca) under Avino’s profile and filed on Form 6-K with the SEC.

La Preciosa Highlights

Indicated Mineral Resources (at 120 AgEq g/t cutoff):

- 113 million silver equivalent oz

- 17.4 million tonnes

- Average silver equivalent grade of 202 AgEq g/t

- Average silver grade of 176 Ag g/t

- Average gold grade of 0.34 Au g/t

- 99 million ozs contained silver

- 189 thousand ozs contained gold

Inferred Mineral Resources (at 120 AgEq g/t cutoff):

- 24 million silver equivalent oz

- 4.4 million tonnes totaling 24 million AgEq oz

- Average silver equivalent grade of 170 AgEq g/t

- Average silver grade of 151 g/t

- Average gold grade of 0.25 g/t

- 21 million ozs contained silver

- 35 thousand ozs contained gold

Notes:

The stated mineral resources comply with the disclosure requirements of NI 43-101 and are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards – For Mineral Resources and Mineral Reserves”.

Mineral resources for La Preciosa are estimated at a cut-off grade of 120 g/t AgEq.

Mineral resources for La Preciosa are estimated using a long-term silver price of US$19.00/oz and a long-term gold price of US$1,750/oz.

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Tonnage and metal content figures are expressed in thousands and may not add up due to rounding.

The above content contains “forward-looking information” and “forward-looking statements” (together, the “forward looking statements”) within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company’s La Preciosa property, located near Durango in west-central Mexico (the “Avino Property”) with an effective date of October 16, 2023.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards. The U.S. Securities and Exchange Commission (“SEC”) now recognizes estimates of “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” and uses new definitions of “proven mineral reserves” and “probable mineral reserves” that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” that the Issuer reports are or will be economically or legally mineable. Further, “inferred mineral resources” are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.