Most Recent Update - Preliminary Feasibility Study:

In February 2024, Avino Silver & Gold Mines Ltd. reported the results of the Preliminary Feasibility Study (the “PFS”) prepared in accordance with National Instrument 43-101 – Standards for Disclosure for Mineral Projects (“NI 43-101”) for its Oxide Tailings Project (the “OTP” or the “Project”) at the Company’s Avino Mine Operations located near Durango in west-central Mexico (the “Property”). The work that was completed as the basis for the PFS was managed by Tetra Tech Canada Inc. of Vancouver, BC.

Highlights include:

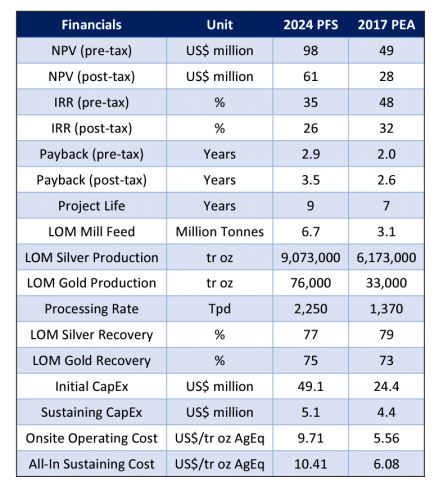

- NPV US$98 million (pre-tax) and US$61 million (post-tax) at a 5% discount rate.

- IRR 35% (pre-tax) and 26% (post-tax).

- Payback Period 2.9 years (pre-tax) and 3.5 years (post-tax).

- Initial Capital Cost: US$49.1 million, including a complete on-site tailing leaching plant for silver and gold extraction and a contingency provision in the amount of US$5.3 million. The ongoing sustaining capital cost is US$5.1 million.

- LOM Average Production Unit Cost: On-site Operating Costs (OOC) and All-In Sustaining Cost (AISC) of US$9.71 and US $10.23 per tr oz silver equivalent, respectively.

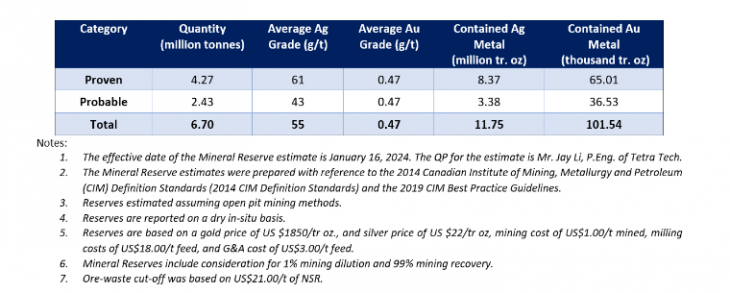

- Proven and probable mineral reserves of 6.70 Million tonnes at a silver and gold grade of 55 g/t and 0.47 g/t respectively.

- Nominal Processing Rate over a 9-year LOM: 2,250 tonnes per day or 821,250 tonnes per year, with a 92% plant availability.

- Metal Recoveries: 77.2% Ag and 74.9% Au.

- Doré Production: Total 9,073,000 oz Ag and 76,000 oz Au, life-of-project (averaging 1,008,000 oz Ag and 8,445 oz Au per year).

- Direct Employment: 121 employees, with additional job positions related to indirect employment and contracted services.

- Ease of Construction and Operation: The Project is located within the existing Avino Mine operations. Site infrastructure such as power, water, and road network are well established.

- Elimination of risks associated with the conventional tailings design: A secondary Dry Stack Tailings Management Facility will comprise dewatered tailings being stored in a geotechnically stable impoundment.

- Elimination of risks associated with the heap leach design, which is replaced with a conventional tank leach design with a compact footprint. The process plant containment areas and berms on site will provide an additional layer of safety.

- The Project will generate US$52.4 million in tax contributions to the local economy and government.

The PFS will be filed on SEDAR+ (www.sedarplus.ca) under the Company’s profile and filed on Form 6-K with the U.S. Securities and Exchange Commission within 45 days of this release. All currency values are presented in US$ unless otherwise specified.

The most notable improvement in the PFS financial results compared to the 2017 PEA is the 100% increase in Net Present Value (NPV) to US$98 million from US$49 million on a pre-tax basis. Other PFS highlights of significance include strong project economics, long mine life, minimal payback period, and exceptional ESG and tax contributions to the local economy.

Comparison to previous study:

Avino Oxide Tailings Project Mineral Reserves

The Mineral Reserves were estimated using both oxide and sulphide tailings and are based on Measured and Indicated Resources only. The pit design used for the estimation was at the PFS level. The ultimate pit limit was determined by the Lerchs-Grossman optimizer in Datamine™, with consideration of economic parameters and physical constraints such as pit road widths, mining bench width, and face angles for the recommended mining equipment. The Proven and Probable Mineral Reserves are given below.

Mineral Reserve Statement of the Avino Oxide Tailings Project (Effective Date: January 16, 2024)

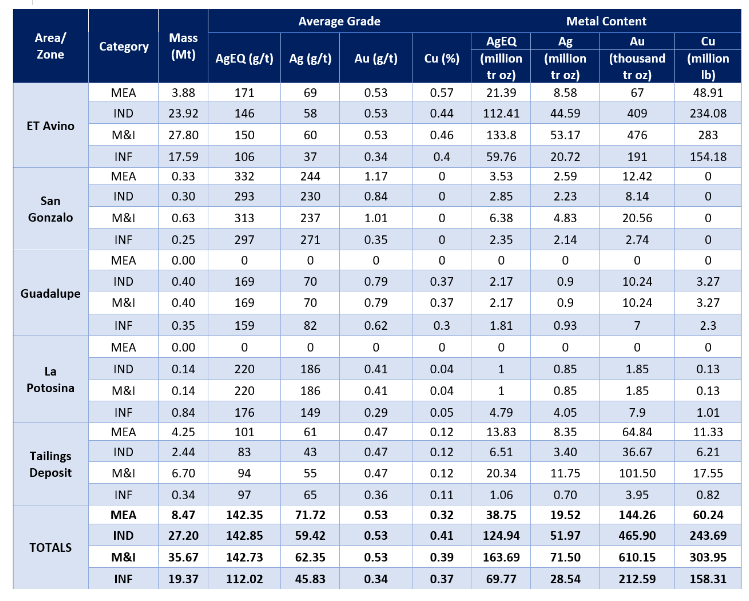

Mineral Resources

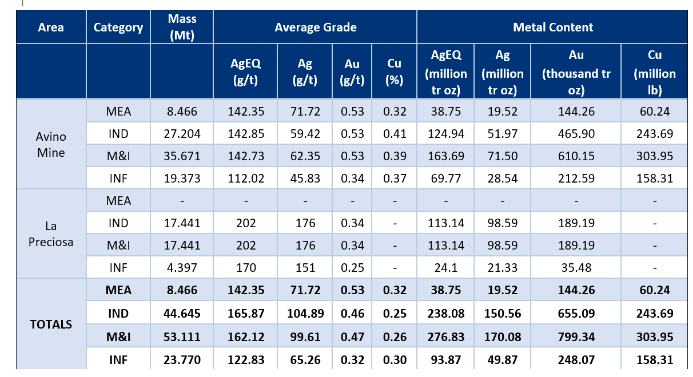

The PFS uses the latest updated mineral resource estimate that is based on US$1,800 per ounce gold, US$21.00 per ounce silver, and US$3.50 per pound copper. In addition, the resources are constrained by conceptual mining shapes. Measured and Indicated Mineral Resources at the Property are estimated at 34.7 million tonnes grading 63 grams per tonne silver, 0.54 grams per tonne gold, and 0.39% copper (70 million ounces of silver, 597 thousand ounces of gold, and 301 million pounds of copper). An additional 19.3 million tonnes are estimated in the Inferred Mineral Resource category grading 46 grams per tonne silver, 0.34 grams per tonne gold, and 0.37% copper (28.4 million ounces of silver, 213 thousand ounces of gold, and 159 million pounds of copper).

The mineral resources of the tailings deposit have been updated during 2023 in accordance with revised topographic data.

Avino Mine Area – Mineral Resources (inclusive of Mineral Reserves, Effective Date: October 16, 2023)

Avino Property (including La Preciosa area) – Mineral Resources (Inclusive of Oxide Tailings Mineral Reserves, Effective Date: October 16, 2023)

The Oxide Tailings deposit comprises historic recovery plant residue material deposited during the earlier period of open pit mining of the Avino Vein, when there were poor process plant recoveries for silver and gold. The oxide tailings are partially covered by younger unconsolidated sulphide tailings on the northwest side of the property.

To view the February 5th, 2024 News Release in its entirety, please click here: Avino Reports Oxide Tailings Project Prefeasibility Study With After-Tax NPV Of US$61 Million And 26% IRR

Qualified Person(s)

The Qualified Persons as defined by NI 43-101, who are responsible for the technical content of this news release are:

- Hassan Ghaffari, P.Eng., M.A.Sc., Director of Metallurgy, Tetra Tech Canada Inc.

- Michael F. O’Brien, P.Geo., M.Sc., Pr.Scit.Nat., FAusIMM, FSAIMM, Principal Consultant, Red Pennant Communications Corp.

- Jianhui (John) Huang, P.Eng., PhD, Senior Process Engineer, Tetra Tech Canada Inc.

- Jay Li, P.Eng., Senior Mining Engineer, Tetra Tech Canada Inc.

- Peter Latta, P.Eng, MBA, VP Technical Services, Avino who is a qualified person within the context of National Instrument 43-101 has reviewed and approved the technical data in this news release.

Links to Historical Information:

February 16, 2023 - Updated Mineral Resource Estimate including the Property’s Oxide Tailings

April 5, 2023 Avino annouced favourable Metallurgical Results from the Oxide Tailings Project

April 11, 2017, Avino announced an Updated Preliminary Economic Assessment (“PEA”) for re-treatment of the Avino mine tailings in Durango, Mexico. The April 11, 2017 Technical Report can be viewed here.